In early 2013, when I bought my first Bitcoin, the altcoin scene was very different than it is today. At the time, the euphoria of Bitcoin was rubbing off onto the secondary and tertiary cryptocurrencies and there were people who genuinely thought that there could be “a silver to Bitcoin’s gold” or that altcoins could provide a useful testbed for features not yet incorporated into the Bitcoin protocol.i There weren’t even that many altcoins to choose from then, maybe a few dozen and certainly less than 100.ii

At that time, the leader of the pack was Litecoin, Charlie Lee’s “democratic”iii coin experiment. Even as recently as 7 months ago, the last time Bitcoin’s price went nutty,iv Litecoin was all the rage. It was The Next Big Thing and peaked around $50 per coin right when BTC hit $1,100, making it the Next Best Thing too.

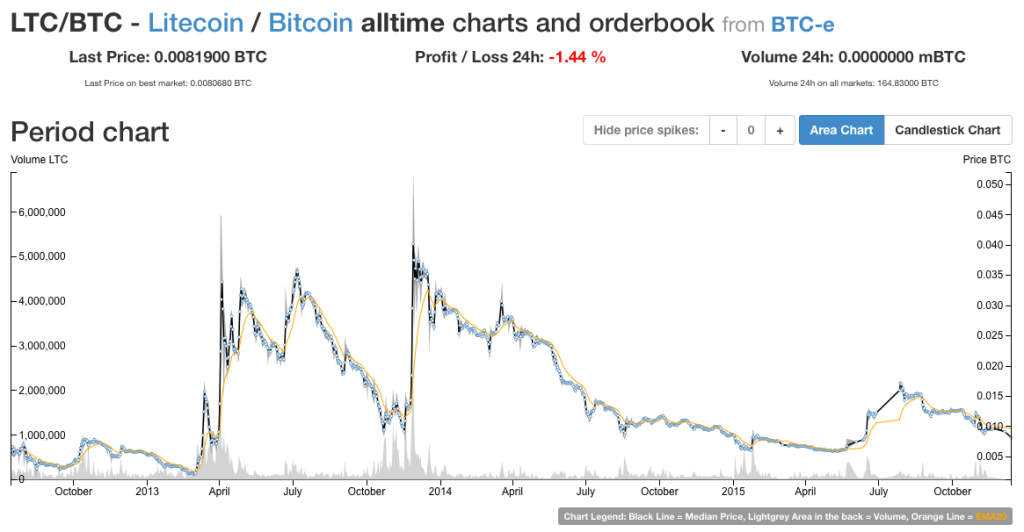

Then this happened.v

But how? How did Litecoin become just another altcoin/scamcoin?

After Googling “litecoin advantages over bitcoin” I came up with this ZDNet article from December 2013, back in Litecoin’s halcyon days. Let’s allow the article’s author, Jason O’Grady, to walk us through the wonder that is Litecoin to see if we can’t see where it all went so wrong.

Although Bitcoin is the media darling, Litecoin is a better option for the average user wanting to get into crypto-currency mining.

Right off the bat, we see that Litecoin is pitched at the “average user.” This, of course, is a huge red flag that Litecoin is doomed to failure. Products and services aimed at the lowest common denominator must necessarily be shit. This works in every aspect of finance and society. If you don’t believe me, take the Bitcoin Securities Exchange scene for example.

At around US$30/LTC, it’s more affordable to outright purchase too.

This author, like many a CoinDesker, is of the mistaken belief that buying a whole shitty thing just because you can afford it is better than buying a part of something far superior. Today, you can buy a million satoshis for $6 or you can buy most of the Dogecoin for sale on the market. Incredibly, some people will actually go for the latter.vi This is nonsense. By this logic, if you’re trying to find transport to the next town, it’d be better to buy one rollerblade than a bus ticket.

So what other reasons are there to choose Litecoin?

A group of people saw this hardware race as detrimental, and sure enough we see the effects of it — namely expensive/risky hardware on an quickly rising difficulty level. Thus it’s very difficult to continue participating without large investments to stay ahead. This group of people proposed a new coin type — Litecoin (LTC) –– that relied on an algorithm that would be resistant to a rapidly escalating hardware race, one that needed fast memory and lots of it. These components are more expensive and present a serious barrier to entry for a Litecoin ASIC that would be economical.

Ah! Mining! Needless to say, many derps still think that the hashrate race, that element that secures the network, is “unfair”vii and that the confirmations aren’t fast enough to make Bitcoin a useable consumer technology. Not that anyone particularly cares about these points. Ironically, scrypt ASIC miners are now being developed by the likes of KNC Miner and are getting ready to fuck up Litecoin and the other scrypt-based coins quite badly. With even fewer players developing scrypt ASICs, the hashing power will be ever more centralized. On the consumer side, people are still perfectly content to use their Dollars, Euros, and Pesos. And why risk keeping something so valuable on your phone just so you can buy a latte?viii

Litecoin also has four times as coins scheduled to be mined (84 million versus bitcoin’s 21 million), which may make it more accessible to future participants. Perhaps not though, as both coin types can be subdivided to eight decimal places.

O’Grady gets it exactly right here and sees through Litecoin’s marketing gimmick. More coins confer precisely zero advantage, as Dogecoin also demonstrates.

It will be easy to accept Litecoin in a world that also accepts Bitcoin (since the technologies are nearly identical).

The merchant angle would hold water, if cryptocurrencies were proving to be consumer technologies, which is dubious despite the raft of new merchants accepting it.ix Very few people are working on merchant processing or POS systems for altcoins either. It’s really Bitcoin or nothing at all. When it’s the best store of value the world has ever known, why roll the dice with other junk?

Litecoin was never able to demonstrate its superiority. Nothing has.

And that’s it. Litecoin lost the marketing as well as the technical battle. It isn’t the silver to Bitcoin’s anything. It’s just another scamcoin that had its moment in the sun and will now be relegated to the history books next to Keisercoin, Auroracoin, and MaidSafeCoin.

If you have any altcoin that’s been around for >6 months sitting in a wallet somewhere, their time has come and gone. Kids with dreams of riches who play daytrader on Cryptsy have moved on to the next shiny thing. Now would be a good time to find an alternative. Salvage what you can.

And allow me to suggest Bitcoin.

___ ___ ___

- There have been very, very few examples of useful altcoins. I’ll leave the identity of such examples as an exercise for the alert reader.↩

- There are literally too many altcoins/scamcoins to count today. N.B. “altcoin” and “scamcoin” are necessarily interchangeable as so very few altcoins have proven otherwise in the long run.↩

- mircea_popescu: you know it just occurs to me, the democratic political process and open source software have a shitload in common.

mircea_popescu: the only reason shit like the openssh was full of is even getting fixed at all is that it costs nothing to alter code.

mircea_popescu: if you had to pay fiddy bux to edit github bleedin’ heart would still be there and a bunch of dorks all over the web would be explaining how it’s not really that bad

mircea_popescu: policies already in place cost about that much to change and it’s how it works.

mircea_popescu: both methods of organising labour are utterly horrible for anyone interested in quality work. they do deliver a very extensive array of crap

mircea_popescu: unfortunately… it’s generally very crappy.

MP via #bitcoin-assets ↩ - What with all the insider trading at Gox. See The Willy Report.↩

- Chart via cryptocoincharts. Updated December 16, 2015 because last chart went rogue.↩

- I knew a girl like this in University. She worked as a waitress at the casino, was making good coin, and wanted to buy a new car. For the same $35k, she could’ve bought an entry-level Lexus IS250, which she considered, but she chose to buy a decked-out Kia Optima on $5k rims instead because she wanted “the best” not something “entry-level.” She ended up with a roughly shod beige box that depreciated so fast it made her head spin rather than a modestly-appointed but rock-solid luxury car from a reputable brand. And this was before Peter Schreyer had a chance to improve Kia’s design language, making the girl’s choice that much more unbelievable. Let this be a lesson. ↩

- This, despite the fact that Satoshi Nakamoto chose SHA256 quite intentionally to minimize the network susceptibility to botnets, which are cheaper and more insidious than ASICs.↩

- Even Blockchain.info, apparently the safest of the webwallets, is the yacht with the fewest holes in its hull. From Twitter:

@bitcoinpete: The security fail @blockchain won’t tell you about: http://fr.anco.is/2014/06/16/the-security-fail-blockchain-wont-tell-you-about/

@aantonop: @Blockchain @bitcoinpete All bitcoin wallets are “potentially insecure”, blockchain’s less so than anyone else.

@aantonop: @Blockchain @bitcoinpete 100% security doesn’t exist. There are weaknesses in any system. We manage these risks…

@bitcoinpete: @aantonop @blockchain Dat marketing. You’re still selling the yacht with the fewest holes in the hull. Won’t stop sinking.Update 16/12/2015 : this was published just shortly before it was revealed that blockchain.info was revealed to have insufficiently random nonces for private key generation, be vulnerable to 2FA work-arounds, and before they were “hacked” to the tune of 267 BTC.

Unsurprisingly, Andreas M. Antonopoulos was turfed shortly after this conversation.↩

- Expedia just announced last week that they’re now accepting Bitcoin. No word on when they’ll start accepting scamcoins.↩