I’m a big believer in bubbles.

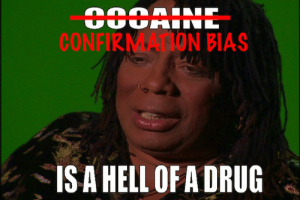

Not just ponzi bubbles of the sort that shape our economies, societies, and lives in ways that are only manifestly apparent during such epochal reassessments as this particular estuary – seriously, it’s bubbles all the way downi – but especially informational bubbles. After all, we are what we eat, whether nutritionally or informationally, and it’s therefore vitally important that we priviledge the best quality inputs given our respective means and abilities.ii Those of us with more considerable resources can afford to try this diet or that subscription, or to get lost down this rabbit hole or that worm hole, but this power also comes with a responsibility to be neither blasé nor lose the forest for the trees,iii and to stay as open-minded and curious as possible. Basically, we want to emulate infovores like Tyler Cowen in mind and spirit… if not in body!iv

So with the reflective holiday season upon us and with Omicron cases soaring,v it was the perfect week to expand my well-trodden 2021 bubble of “NFTs/web3/crypto are mankind’s panacea and will solve all of our problems before we know it.” Ironically, this meant taking Twitter off my phone and reducing my time spent on that psyop-infested scroll-fuck by a solid 90%, which magically opened up all kinds of opportunities to read long-format noodle-twisters such as these following articles, a few quotes from which I found particularly challenging, starting with Ben Edgington via Lyn Alden:vi

Another [potential Proof-of-Stake attack] is called a long-range attack and this is kind of subtle, but the idea is that once you’ve exited the network as a validator, you can then go back in time, effectively. So I exit the network and I can go back a month in time, and produce (if I have enough validator keys) as many historical blocks as I wish, I can write a different history for the chain, effectively, which conflicts with its current history, and I’ve exited so I can’t be slashed anymore. So that’s a long-range attack. We have an analysis of this, and an understanding of this, which Bitcoiners will hate but we call it “weak subjectivity”. It’s the idea that anybody who is continually online is always safe, because they are monitoring the chain and they always know what the correct chain is. If you sync from scratch, you know you sync from genesis, there is a danger that you follow an attacker chain, so you need a checkpoint, which guarantees that you are on the right chain, which you need to get from someone who has been online for the entire period or somebody who is guaranteed to be on the right chain. Now that is called “weak subjectivity”. There are rules about how frequently these checkpoints need to be produced, how we can rely on them, and we are building “somewhat trustless” mechanisms for getting hold of these checkpoints. It is, I understand, a deep clash with Bitcoin ideology in that sense that anybody in vacuo should be able to sync up from genesis and know they are on the right chain without trusting anybody in any way, shape, or form. We’re not doing that. That seems to be very difficult with proof-of-stake, that’s a compromise we made, but we believe in practice this is completely workable and will not lead to any practical attacks of any sort.

Though to be fair to Proof-of-Stake, can anyone who’s ever actually run a Bitcoin node seriously imagine just syncing the chain IN VACUO?? Like wtf is the point of “advertised republican nodes” if not to sync from trusted (ie. WoT) parties? The notion that distrusting randos is “a deep clash with Bitcoin ideology” is some kinda tinfoil hat revisionist history shit. But hey, MSM wants to talk about how the “Big Block Debate” was killed by some HKers instead of TMSRers, so you can’t put it past them. Alas, it’s useful to step back and consider that the continuously delayed PoS system might not just have execution risk, which is does,vii but also technical security risks, in spite of Vitalik’s seemingly solid quantificationsviii as to the increased costs of attacking PoS relative to PoW.

Lyn Alden continues:

But besides those two obvious centralization hubs, the often-overlooked sources of power are the largest stablecoin custodians. They have basically enough power at this point to dictate which Ethereum blockchain is valid, in the event of a hard fork. With $115 billion in assets between them, the two largest stablecoins have a lot of influence over Ethereum and other smart contract blockchains.

When a hard fork happens, stablecoin custodians cannot recognize both sets of tokens as redeemable for their money, since there are now twice as many total tokens (two full sets, one for each fork of the blockchain). They have to pick which blockchain is the valid one in their eyes, for which they accept redemptions of their tokens for money. And whichever one they don’t recognize as valid, has its DeFi and other stablecoin value eradicated. Most of the $100 billion in AUM locked up in DeFi protocols, the core lifeblood of Ethereum, is reliant on centralized stablecoins, as well as the stablecoins that are used by centralized offshore exchanges or that are being used for payments.

I rarely give much thought to the political implications of using USDT, USDC, DAI, etc. but I’m only recently becoming more familiar with them at all. So this point is particularly worth considering. Though to be fair to Ethereum again, it has always been and will always be the case that the largest economic players in Bitcoin have determined its course when hard forks arose, as we saw back in the old days with the sinking of Hearn, Ver, Garzik, Andresen and the rest of the would-be subversives of our self-sovereign digital gold. While I’ll concede that there is some risk of regulation and blacklisting with stablecoins, I can’t imagine a decentralised world without workarounds for “live players,” to borrow a Burja-ism, but at first glance DAI would seem to be the safest play from a regulatory arbitrage perspective, though thoughtful commenters are, as always, invited to do me an educate below!

Let’s now turn to Stefan Eich:ix

Rather than speaking about the “depoliticization” or the “repoliticization” of money [with regards to cryptocurrencies] we would be much better off to appreciate that the politics never goes away and that instead much of what passes as the “depoliticization” of money is better understood as the “de-democratization” of money.

This can help us to begin to pierce some of the ideological smoke screen that surrounds crypto and that is actively fueled by the crypto community. Theirs is a deeply peculiar kind of politics and one that forces us to grapple with the deep incongruities between their outward ideological rhetoric and the underlying actual political logic.

On the level of rhetoric, we can distinguish between two distinct strategies. The first, closely associated with Bitcoin and its early adopters, offers a vision of money not just beyond the state but liberated from all politics. This is the original Bitcoin vision of money beyond trust and hence beyond any form of power or politics. It draws heavily on what Fred Turner has called the anti-political side of the counterculture that morphed into cyberculture in the course of the 1980s. Much of the early cypherpunk vision of electronic money drew on that anti-political strand of the counterculture.

But, and one cannot stress this enough, this is obviously a complete delusion and a very dangerous one. Power, trust, and politics will always form part of money and the same is true for cryptocurrencies, including Bitcoin, as anyone will attest who has spent any time studying them.

From the oligopolistic power of miners, to the associated energy consumption, to underlying questions about design the consensus protocol, to disputes over so-called forks in the blockchain, politics and power don’t disappear and their imprints can be found are all over crypto.

A second set of strategies essentially grants as much and is no longer wedded to the claim of crypto is beyond politics but it adds a perverse twist to it. Decentralization is on this account no longer presented as allowing us to transcend politics but instead as allowing for a new democratization of money. Where the first rhetorical strategy is a (self-)delusion, this is a sleight of hand based on a bizarre understanding of democracy. Democracy on this reading is a libertarian fiction opposed to the state and any form of mass politics. Alongside crypto, much of fintech, and decentralized finance today has adopted the slogan of “democratizing money” or “democratizing finance”. Not only is that an empty meaning of democracy but it’s one that conflicts directly with what political theorists actually consider essential to democracy: namely, forms of collective decision-making based on the egalitarian principle of “one person, one vote”.

Instead of this basic democratic principle, the crypto conception of democracy is essentially the old neoliberal aspiration of “one dollar, one vote.” Contrary to egalitarian conceptions of democracy as a form of rule based on collective agency, the FinTech fantasy of democracy as decentralization is simply the freedom of the stronger trumping that of everyone else but now wrapped up in the gibberish of Blockchain-speak.

If there’s any defense of the ideological smoke screen propagated by crypto-enthusiasts like yours truly, it’s that our vision of “democracy” is much closer to the Ancient Greek version, where this “abused” term actually derives from, rather than the tails-of-the-distribution-clipping/white-picket-fence version we saw after the last World War. And ideally our new systems offer voluntary exit as opposed to the student-debt/mortage-debt-saddled-wage-slaves of the soi-dissant “democracies” extant, though admittedly the details on how to keep the basic physical infrastructure of a society running smoothly without such subjugated violence is an open question to my mind. But leaving that alone for a minute, maybe if we meant “equalizing” instead of “democratising,” we’d just say that, y’know. Is that wrong of us to be so cold? Does that make us terrible people? Or is our still-vague vision more sustainable for both human society and a natural environment that’s been all-but decimated by the last few generations of mass consumerist cruelty.x Not that such conclusions are at all obvious to most crypto-enthusiasts, most of whom are so geeky, so awkward, and so insular that they can’t imagine being politically responsible, but this is why Napoleon had to rely on much of the echafaudage of the ancien regime for his support, just as Lenin did with the Tsarist aristocracy, in their respective ascendancies to power as “revolutionaries.” And so it is that the new crypto-elite will ultimately have to coordinate and collaborate with the few existing elites of 20th century WASP culture that aren’t completely asleep at the wheel. I get that our crypto-cultural language is, well, cryptic, and it’s a genuine shame when this is done without deeper meaning, but it’s highly protective when done intentionally, not least of all from the darker and more purely sociopathic elements of the new crypto-movement. Besides, what is politics if not lying? You want the truth, you can’t handle the truth! But this isn’t to admit that there isn’t something saddening in watching something die, whether that death is of a movement such a “crypto art pre-2022” or “democracy pre-2001.” We’re all human after all, and this fourth turning is a painful transition, as they all must be.xi We can at best hope that it’s a relatively bloodless one compared to the Great Wars of the last century, but of this we certainly have no guarantee.

Brian Eno has a swipe next:xii

I can understand why the people who’ve done well from [NFT/crypto speculation] are pleased, and it’s natural enough in a libertarian world to believe that something that benefits you must automatically be ‘right’ for the whole world. That belief is a version of what I call ‘automaticism’ – the idea that if you leave things alone and let something or other – the market, nature, human will – take its course unimpeded you will automatically get a better result than you would by tinkering with it. The people who hold beliefs of this kind don’t have any qualms about tinkering themselves but just want a situation where nobody else gets to tinker. Especially the state.

Countering this point, “there is neither good nor bad but thinking makes it so.” Also, the crypto/web3 world has lots of impedance! Most of it technological but also some sociopathic, as earlier discussed. As such, the crypto-movement is moreso a desire to shift power from one maladaptive and particularly ossified group of dead players to another rather vivacious group of tech-savvy live players. At the very least this comes with the promotion of YIMBYism (ie. just buidl) instead of the stultifying NIMBYism so pervasive in the western world (ie. grease a thousand palms before you buidl). How could that new shift not be better? How could agency not go to the active? But I get it too, if I was as old as Eno, I’d be perturbed watching my institutions fail, even if crypto is misattributed as a cause rather than an effect of said failure.

Eno continues:

I’ve been approached several times to ‘make an NFT.’ So far nothing has convinced me that there is anything worth making in that arena. ‘Worth making’ for me implies bringing something into existence that adds value to the world, not just to a bank account. If I had primarily wanted to make money I would have had a different career as a different kind of person. I probably wouldn’t have chosen to be an artist. NFTs seem to me just a way for artists to get a little piece of the action from global capitalism, our own cute little version of financialisation. How sweet – now artists can become little capitalist assholes as well.

Brian Eno is a legendary artist not for his financial success, it’s true, but we also can’t pretend that he hasn’t mastered other levers of power. Or else, let’s be real, we wouldn’t be talking about him today. Power isn’t just money, it can also be friends, servants, reputation, success, affability, nobility, eloquence, and being handsome, per Thomas Hobbes. If we look at successful digital artists today, none has accrued financial capital without also minding and strengthening their other levers of power, just as it’s always been. So what’s really changed? Secondary market royalties – for now – and some degree of disintermediation, neither of which makes this new wave of digital artists “little capitalist assholes,” in my humble opinion, but I also respect Eno enough to take his back-handed compliments of our space in stride. He’s set, he’s powerful, and he’s not hungry for a white space within which to establish himself, as the rest of us in crypto are. If that makes us assholes, then so be it.

A final swipe for this week from Brian L. Frye:xiii

By the end of 2021, Punk and Ape prices were converging. Why? One reason for BAYC’s ascendance might be a more liberal approach to licensing. Yuga Labs permit NFT owners to use and even license their Apes, which has led to the manufacture and sale of clothing, beer, and other products sporting BAYC imagery.

It’s understandable why Larva Labs would want to control the use of its works: intellectual property is twenty-first-century gold, so companies protect it reflexively. But it also doesn’t make much sense. Realistically, what is Larva Labs going to do with the copyright to ten thousand Punks? Punk owners are far more invested in their own Punks than Larva Labs could possibly be. Any economist will tell you that an efficient market allocates property to whoever values it the most. Intellectual property is no exception. Yuga Labs recognized the synergy of its interests and those of its collectors, and made that part of its business model.

This one hit pretty close to home as the ass continued to fall out of the market for my beloved Punks while the obscenely derivative and gratuitously gauche (but brilliantly marketed!) Bored Apes ascended to the point of briefly “flipping” floors with the OG Larva Labs project. Indeed, for the last few weeks as these markets converged, I scraped the bottom of my analogy barrel in an attempt to defend my increasingly vulnerable Punks investment thesis, and I ultimately failed to find another single example of a successful collectible or art project by a living artist with no formal marketing or community engagement to speak of. Storytelling makes the world go round!!! Whether it’s Damien Hirst or Rolex or Mercedes, creating a great product is never enough, so why should LL (or their gallerists/promoters/etc) be spared the same responsibility? I’m still not sure that I have the answer to this but I’m currently unsatisfied with the idea that living artists can be such complete hermit crabs so as to consider their artistic outputs as necessary and sufficient for both market and historical success. LL put some of these concerns to rest later in the week with their announcement of a new open-source zero-fee marketplace, a timely reminder that they do more than just program algorithmic visual art but also technical-code-as-art, which sent the market up 30%, but the next best consolation is that it’s up to us, the decentralised collectors to steer the ship, frightening as that sounds.

This was a long one… so that’s all for this week. And remember, sometimes you gotta pop a few bubbles to make your own bubble-ade.

___ ___ ___

- To quote cultural commentator par excellence Matt Levine vis-a-vis radical transparency and first principles thinking:

The “(3, 3)” meme is a sort of casual adaptation of game-theory payoff notation. The idea is that if you sell your OHM that is bad for you (you don’t own OHM any more) and bad for everyone else who owns OHM (your selling pushes down the price of OHM); if everyone sells, that has a payoff of “(-3, -3).” But if you buy OHM and stake it, that is good for you (you get more OHM) and good for the other OHM holders (your buying pushes up the price of OHM); if everyone stakes, that’s “(3, 3).” The ordered pair represents payoffs for you and for the other player in this game; the numbers are arbitrary.

Also OHM pays a comically large interest rate (in OHM) to holders who stake their OHM. Currently it has an annual yield (again, in OHM) of around 5,200%. Higher than the lira!

When I first read this explanation in the OlympusDAO documentation, I laughed and laughed. “Well yes right,” I thought, “the way a Ponzi scheme works is that early ‘investors’ get rich as long as later investors keep buying more.” Sure, (3, 3). “If we all keep buying this thing its price will go up and we will be rich” is absolutely the main financial theme of 2021, but it is an irreducibly silly theme and I would be embarrassed to formalize it with game theory.

But of course crypto people will happily tell you that fiat currency is the biggest Ponzi scheme of all, and they are not really wrong are they? Erdogan’s pitch is the same as Olympus’s: If we all stake our lira, we will all do well; if enough of us “defect,” we will all be in trouble. But of course that’s true of every fiat currency; it is particularly saliently true of the lira right now, but if everyone sold their dollars to buy euros (or Bitcoins, or OHM), that would be bad for the dollar too. “The value of a currency depends on its widespread social acceptance, though it can be influenced in the short term by the interest rate that you can get in that currency” is such normal everyday stuff that you don’t think about it much. But if you’re reinventing currency from scratch, you do.

- “Means and abilities” obviously aren’t just financial, but also the availability of time, and really any other “resource” we can muster. There are lots of rich people with no time and we might call such people “rich” but perhaps not “wealthy,” whereas those of us with strong family relationships and time to enjoy them are by some measures at least wealthier than kings. ↩

- Like Jack did this week! ↩

- We still love you TC, even though you’re no spring chicken anymore! ↩

- Nothing like a little fourth wave to turn those of us with travel plans in the next 4-6 weeks into little game theoreticians again. ↩

- Archived. ↩

- Ethereum PoS always seems to be 3-6 months away™ but at least Beacon Chain is a thing. ↩

- Archived. ↩

- Archived. ↩

- Something like 70% of all vertebrate species on the planet HAVE GONE EXTINCT SINCE 1970. Coincidence? ↩

- “The Fourth Turning: An American Prophecy” by William Strauss and Neil Howe is mega-recommended reading. H/T Raoul Pal! ↩

- Archived. ↩

- Archived. ↩

[…] as the closest thing to Stuttgartian sprezzaturaiv anywhere in this crazy, branding-bonkers, everything-is-an-asset-class-because-zirp environment, the GT3 is the centrepiece of the entire Porsche company, around which the hype, […]

[…] strong enough!iv Powerful enough to heed its historical call Instead of fighting for lambos amidst bubbles We could fight for power, through […]